This factsheet was created with the intention to support:

This factsheet was created with the intention to support:

Organizations, researchers, scholars, activists, communities and individuals

To learn, share and act on the threat that biodiversity credits pose by understanding the functioning of this financial mechanism and its emerging players.

To understand the potential risks and dangers of biodiversity credits implemented without adequate regulation, development, impartial monitoring and community participation.

A more detailed analysis on this is available in our report called “Biodiversity is Life, not an Asset Class: Debunking biodiversity credits, the next wave of Bio Imperialism”.

To find out more, join the campaign «Biodiversity is Life, not an Asset Class«.

Understanding Biodiversity Credits – A Factsheet

The world is facing a serious ecological crisis. Global biodiversity has been eroded by 69% since 1970, with tens of thousands of populations of wildlife at risk of extinction across the planet. The loss of biodiversity is continuing unabated despite the fact that, at an international level, the urgency of regenerating and protecting it has long been recognized.

To counteract the erosion of biodiversity, the private financial sector has been moving for several decades, proposing various financial schemes to minimize the damage caused by global industry on the planet’s ecosystems.

The carbon market is a famous example, born in 1977 from the Kyoto Protocol and widely criticized for its inability to produce tangible results and lack of effective control. In recent years, we are observing a new financial mechanism, aimed at “protecting” the planet.

What is financialisation of nature?

Financialisation of nature refers to the process of incorporating natural ecosystems and biodiversity into financial markets and economic systems.

This involves assigning economic value to natural resources and ecosystem services, and then trading or managing these values through financial instruments.

Some of these market-based instruments include Biodiversity Credits, Carbon Credits, Water Rights and Trading, environmental impact bonds, green bonds, impact investing, and Natural Asset Companies. Financialising nature reduces complex ecological systems to mere economic units, overlooking the intrinsic value of ecosystems and the interconnectedness of species.

Why is it important right now to know about financialisation of nature?

The United Nations Biodiversity Conference of the Parties (COP16) to the UN Convention on Biological Diversity (CBD) is from October 21 to November 1, 2024, in Cali, Colombia. This gathering is a crucial moment of decision making for our future when the world is facing a grave biodiversity crisis, with global biodiversity having declined across the globe.

Financialisation of nature continues the harmful legacy of bio-imperialism with its commodification and extraction, which is at the root of this biodiversity crisis. It monetises this crisis to help the market players generate profits.

The World Economic Forum foresees that just the biodiversity credits market alone might hit $2 billion by the decade’s close and by 2050, it could touch nearly $70 billion.

What are biodiversity credits and how do they actually work?

Biodiversity credits represent the latest financial tool to commodify natural resources and ecosystems. They are a scheme aimed at financing activities for the “protection” and “conservation” of biodiversity through the creation, sale and exchange of biodiversity ‘units’.

Biodiversity credits are positioned by finance companies as incentives to fund “conservation” efforts by placing a monetary value on preserving or enhancing biodiversity .

In simplest terms, they are like a reward system for protecting nature where each credit or reward signifies that the landowner or organization “protected” or “restored” a natural habitat. For example, if a company helps to restore a forest, they earn biodiversity credits.

The reason financial companies are interested in these is because these credits can be sold or traded. Companies that need to show their environmental impact buy these credits to show they are “supporting” conservation efforts.

- First, an assessment is conducted to determine the current state of biodiversity in a particular area. This might involve measuring species diversity, habitat quality, and other ecological factors.

- Conservation projects or landowners can then undertake activities that “improve” or “protect” biodiversity, such as restoring habitats, protecting endangered species, or implementing sustainable land management practices.

- The impact of these activities is quantified, often using metrics like the number of species protected or habitat quality improvements. These metrics might include species counts, habitat area, or ecological function.

- Based on the quantified improvements, biodiversity credits are issued. Each credit represents a specific amount of biodiversity benefit, such as the protection of a certain number of species or the enhancement of a particular habitat.

- These credits could then be traded on the market. They can be sold to individuals, companies, or governments who need to offset their own environmental impacts or who want to support conservation efforts.

The idea is that by purchasing credits, buyers are compensating for their negative impact on biodiversity or supporting conservation initiatives. Terrasos’s project in Colombia, for example, sets the value of one biodiversity credit at 10 square meters of land conserved or restored over 30 years.

Similarly, a project developer called ValueNature is providing credits to private sector purchasers where a biodiversity credit, termed a “Nature Investment Certificate” (NIC), is a 10-year commitment to conserve or restore 1 hectare of land in the Tondwa reserve in Zambia.

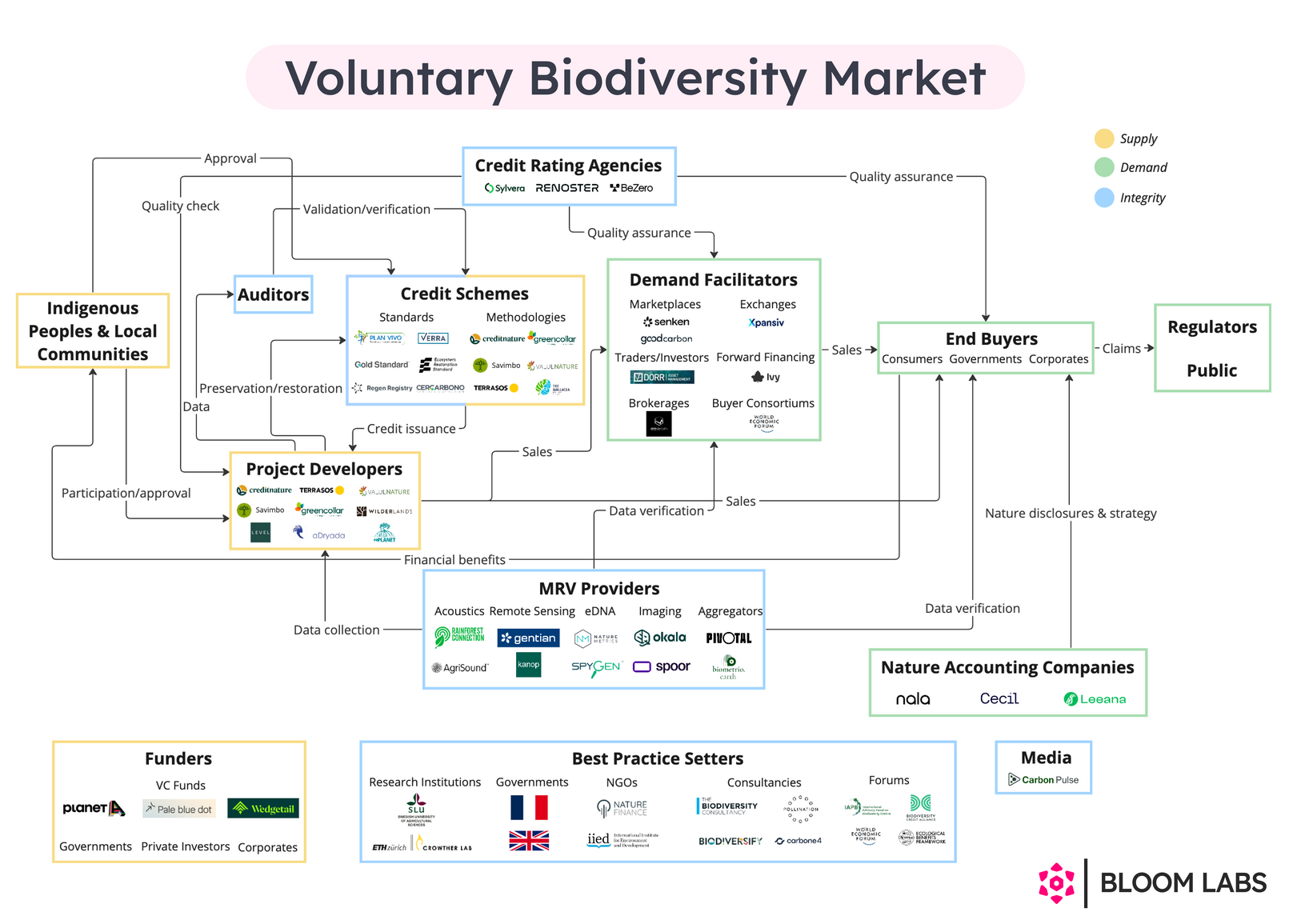

Source: Simas Gradekas (2024). Voluntary Biodiversity Market, Visualized. Available at https:// sgradeckas.substack.com/p/voluntary-biodiversity-market-visualized

Who are the main players in this market?

Biodiversity credits are a financial instrument with fast-growing economic prospects and can either be part of regulatory frameworks (like compliance with environmental laws) or voluntary markets (where organizations or individuals buy credits to meet self- imposed sustainability goals).

As a result, a variety of bodies and coalitions have begun to propose schemes and mechanisms to create, measure, monitor and purchase biodiversity credits. We are observing growing interest from national states, the private sector and international organizations.

It is particularly important to pay attention to large multinational players. Entities and companies operating in the oil, mining and agricultural-industrial sectors are the sectors most responsible for the majority of ecological disasters on our planet in the last 30 years and are at the forefront of ensuring a successful entry of the biodiversity credit market.

In particular, we observe the formation of large coalitions that seek to enter the process of defining market conditions and the measurement and functioning of credits: the World Economic forum along with Mc Kinsey and Co have formed the “Frontrunners Coalition” which aims to develop the biodiversity credit market and is made of corporations from extractive industries including mining, fossil fuels, and pharmaceuticals.

Verra which manages the world’s leading voluntary carbon markets program, the Verified Carbon Standard (VCS) Program, has initiated the Nature Framework Development Group (NFDG) to establish a nature crediting framework, which includes the Blue Nature Alliance (supported by McKinsey & Company), Conservation Finance Alliance, Conservation International, Great Barrier Reef Foundation, International Union for Conservation of Nature (IUCN), The Biodiversity Consultancy, and Verra itself, acting as an independent standard setter.

Plan Vivo Foundation, creators of the most established Voluntary Carbon Market (VCM) Standard, announced in 2023, the launch of their biodiversity standard, “PV Nature”. This new standard is now active.

Projects that include biodiversity credits for the protection and regeneration of ecosystems are developing mainly in Australia, UK, France, South America, Europe and Africa, with new initiatives recently also launched in Italy. Furthermore, UK and France have jointly announced an initiative to develop a roadmap for biodiversity credits, aimed at supporting corporate efforts to enhance nature conservation. Their goal is to reveal this blueprint at the COP 16 summit scheduled for October this year (2024).

Key policies of some of the regions include, the EU biodiversity strategy 2030 being based on a ‘net gain’ principle, promoting ‘nature-based solutions’ and including a future proposal for binding targets for the restoration of degraded land which will «help ensure long-term productivity and value of our natural capital”.

The Australian Federal government introduced the Commonwealth Nature Repair Market Act in 2023 established a framework for the world’s first legislated, national, voluntary biodiversity market. Each project will possess a unique tradable certificate, which owners can sell to buyers through commercial agreements. The status and ownership of certificates will be tracked via a publicly accessible Biodiversity Market Register to track credits and prevent double counting, for this registry systems are often used. These databases record the issuance, transfer, and retirement of credits.

The Nature Repair Market enables registered projects to generate tradable Biodiversity Certificates, backed by the government, linked to activities focused on preserving and restoring biodiversity.

Source: Pollination Foundation (October 2023), State of Voluntary Biodiversity Credit Markets: A Global Review of Biodiversity Credit Schemes. P. 13. https://pollinationgroup.com/wp-content/uploads/2023/10/Global-Review-of-Biodiversity-Credit-Schemes-Pollination-October-2023.pdf

Are biodiversity credits different from offsets?

In reality, there remains large ambiguity regarding the distinction between biodiversity credits and offsets. Green Finance Observatory (GFO) notes that “there is no credible use for biodiversity credits outside of offsetting”, explaining that Biodiversity credits and offsets are functionally identical because both systems are designed to balance environmental destruction with claims of restoration or compensation elsewhere.

Experts argue that biodiversity credits fund conservation efforts, whereas offsets directly compensate for habitat loss. However, through extensive research we have found that this distinction is superficial and misleading, as noted in the report, Biodiversity is Life: Not and Asset Class.

In addition, the co-chair of the IAPB initiative has herself stated that biodiversity credits will be used for offsetting.

For instance, biodiversity offsetting has become mandatory in the UK from 12 February 2024, whereby developers must demonstrate that the biodiversity value of a site post-development will be increased by at least 10% compared to its pre- development state. This enhancement is referred to as “Biodiversity Net Gain”. Under this, landowners can support nature recovery and generate alternative income by offering land for off-site Biodiversity Net Gain (BNG) projects, where developers pay them to maintain these areas in an improved ecological condition. This helps developers meet their biodiversity obligations, provided that the habitat sites are officially registered.

The IIED (International Institute for Environment and Development), which promotes both credits and offsets, acknowledges that credits can produce «net biodiversity gains» but admits that offsets also aim for “net results”. The concept of «net» inherently suggests a balancing act between ecological losses and gains, meaning both systems ultimately involve offsetting. The idea that credits won’t be used as offsets ignores this fundamental overlap.

The IIED (International Institute for Environment and Development), which promotes both credits and offsets, acknowledges that credits can produce «net biodiversity gains» but admits that offsets also aim for “net results”. The concept of «net» inherently suggests a balancing act between ecological losses and gains, meaning both systems ultimately involve offsetting. The idea that credits won’t be used as offsets ignores this fundamental overlap.

According to an investigation by The Guardian, Die Zeit, and SourceMaterial, more than 90% of rainforest carbon offsets certified by Verra—the world’s leading carbon standard certifier—are likely to be “phantom credits.” The analysis revealed that approximately 94% of the credits generated by the projects should not have received approval.

Verra, who has expanded into biodiversity credits, explicitly states that these credits can be purchased to compensate for environmental damage in a value chain. This reinforces the point that credits will inevitably be used for offsetting, despite claims to the contrary. Verra describes scenarios where credits are bought to address nature deficits or destruction, reinforcing that these transactions are offsets under a different name. The preposterousness of the claim that biodiversity credits will not be used for offsetting stems from the fact that the very structure of credit markets is built on the principle of balancing destruction with restoration.

As Frederic Hache from GFO notes, “if offsetting worked 100% of the time, it would merely displace destruction, however since it mostly fails, it leads to an increase in destruction”. It is evident that credits will not protect biodiversity but only fragment and delay real action from the Global North. Without offsetting, there would be little demand for biodiversity credits, as companies primarily seek to mitigate their environmental impacts in order to maintain public relations or comply with regulations. This demand for mitigation is what drives the financial appeal of credits and their inevitable use as offsets, making the distinction between the biodiversity offsets and credits negligible.

Will biodiversity credits under the scheme of financialization of nature protect biodiversity?

Supporters of financialisation, would have us believe that the only way to conserve and protect biodiversity is to adopt new market mechanisms. However, markets have failed to safeguard biodiversity and do not have superior outcomes over traditional regulation. Biodiversity is highly complex and context-dependent. This makes quantifying, accurately measuring and verifying biodiversity impacts a complex exercise. By focussing on specific species or habitats, credits do not fully account for the wholistic web of ecosystem interactions.

Supporters of financialisation, would have us believe that the only way to conserve and protect biodiversity is to adopt new market mechanisms. However, markets have failed to safeguard biodiversity and do not have superior outcomes over traditional regulation. Biodiversity is highly complex and context-dependent. This makes quantifying, accurately measuring and verifying biodiversity impacts a complex exercise. By focussing on specific species or habitats, credits do not fully account for the wholistic web of ecosystem interactions.

Today, 80% of the world’s biodiversity that resides in 22% of world’s land is stewarded by Indigenous people. Their economies of care have outperformed economies of greed and markets. The latter has only led to more deforestation and biodiversity loss.

Carbon offsets show us that biodiversity credits (which will essentially end up as biodiversity offsets) instead of generating more livelihood will actually lead to more land grabbing, more human rights violations and increasingly volatile farmer incomes.

For instance, there was an examination of the New South Wales Biodiversity Offsets Scheme in Australia. This scheme enabled landholders to set up permanent Biodiversity Stewardship Agreements (BSAs) on their properties to generate biodiversity credits, which could then be sold to offset the harm on biodiversity. The audit conducted in the year 2022, found that the Biodiversity Offsets Scheme was completely ineffective in protecting some of the state’s most endangered species and ecosystems. It pointed out serious issues with integrity and transparency, revealing that the scheme did not adequately address the loss of biodiversity due to development.

As seen repeatedly, biodiversity credits are rooted in a paradigm of fragmentation where different places, time and ecologies are standardised for the sake of fitting into reductionist financial instruments. Driven by the sole aim of generating profits, not creating meaningful action that disrupts the status quo responsible for the biodiversity loss in the world, biodiversity credits do not protect biodiversity.

If not financialisation of nature, what will protect our biodiversity?

The financial markets and players would have us believe that nothing other than financialisation exists to protect biodiversity and life on this planet. In reality, small farmers, women, Indigenous Peoples and multiple cultures protecting and stewarding the complex web of life have protected biodiversity in a far richer and deeper way since millennia. The knowledge systems of Indigenous Peoples & Local Communities (IPLCs) arise out of a deep and long understanding of the ecological principles of Nature’s Law and ecological sustainability. They have preserved and ensured healthy living systems and their peoples’ survival through the ages.

True regeneration requires a return to the principles of bio-democracy and peace with the Earth.

Regenerating biodiversity is an act of both conservation, regeneration and bio-democracy—a form of creative resistance against the financialisation of life.

To address the biodiversity crisis, we must fundamentally transform our relationship with the Earth and its diverse life forms. By recognizing biodiversity as a common good, we can build a more just and sustainable future for all by shifting to bio- cultural stewardship, reviving storytelling and celebration of biodiversity and Mother Earth, and regenerating biodiversity and cultures.

Bio-cultural stewards & cultures of diversity:

People and cultures who have lived in harmony with the Earth and have learned for millennia the complex interconnections that support life, promoting the diversification and protection of ecosystems through specific cultural practices. In this sense, culture and biodiversity are deeply connected.

Storytelling and celebrations embed us in Mother Earth and her biodiversity: Recognizing biodiversity as part of the biocultural heritage of Indigenous Peoples, women, and small farmers reveals that preserving their cultures, languages, knowledge, wisdom, and practices is crucial to preventing further biodiversity degradation. This intimacy leads to the conservation and stewardship of local ecosystems, as farmers and communities become engaged in direct relationship with biodiversity.

Regenerating biodiversity and cultures of regeneration:

The true path to addressing the biodiversity crisis lies in regenerating biodiversity as a commons, managed and cherished by local communities, rooted in community stewardship, where biodiversity is valued not as a commodity but as a fundamental component of life that sustains us all.

While financialisation of nature reduces diversity, leads to ecocide, and intensifies the climate crisis, the path of the small farmers, women and indigenous peoples embody the ways of relating, growing, eating, tending and being that nourish the whole web of life that truly conserves and protects the biodiversity on this planet.

They work with diversity, rather than against it, and that is the key to fostering ecological resilience.

The defense of biodiversity is now more important than ever, as it also represents the defense of the small farmer, and the defense of our relationship to life itself.

International campaign to protect native maize in Ecuador and Mexico

Educational programmes as part of Navdanya International’s Biodiversity is Life project

Thank you to Frederic Hache and the Green finance Observatory for their inputs.

© 2024 Navdanya International

All rights reserved. Text reproduction is prohibited, while free sharing and circulation is permitted, as well as quotation of individual parts, provided that sources and authors are cited.

Contacts:

info@navdanyainternational.org

www.navdanyainternational.org

www.navdanya.org

www.seedfreedom.info

Front cover Illustration by Frederic Hache, Green Finance Observatory.

Images shown are our own or under creative commons license.