Cover Photo credits: Fernanda Estrada González

Biodiversity is Life.

Biodiversity weaves the web of life.

It is not corporate property.

It is not a financial asset or commodity of corporations whose greed drives the mass extinction of species and biodiversity loss.

COP 16 in 2024

This year, the United Nations Biodiversity Conference of the Parties (COP16) to the UN Convention on Biological Diversity (CBD) is a conference scheduled to be held from October 21 to November 1, 2024 in Cali, Colombia.

Globally, the COP16 comes at a pivotal moment when biotech and agribusiness are making a desperate attempt to greenwash new biotechnologies and financial schemes, lobby for deregulation and push new and untested technologies out to market faster. All while claiming these so called new biotechnologies and schemes like biodiversity credits and green finance, should be considered sustainable solutions to today’s crisis.

The CBD has been the only international body addressing the governance of these new issues, evaluating their potential impact on biodiversity, as well as their multidimensional implications. This makes the current CBD COP all the more important for our ecological future.

As described in Navdanya International’s Gates to a Global Empire report, starting back in 2016 there was already growing concern over the influence of the business sector over the issues around biodiversity.

At COP 15 held in 2022, the members signed the “Kunming-Montreal Global Biodiversity Framework” agreement which included four goals and 23 key targets for biodiversity action aligning with the 2030 agenda. Furthermore, with support from UNDP, the United Nations Environment Programme Finance Initiative (UNEP FI), and the Swedish International Development Cooperation Agency (SIDA), the Biodiversity Credit Alliance (BCA) was inaugurated during the CBD COP 15. The BCA aims to be a voluntary global coalition, uniting various stakeholders to advance the implementation of the Global Biodiversity Framework, focusing particularly on Targets 19(c) and (d) which advocate for private sector engagement in biodiversity investment, including the use of biodiversity credits with appropriate social protections.

As laid out in 2022, by Navdanya International, The Convention on Biological Diversity Must Resist the Commodification of Life, COP 15 was crucial for providing protection against the increased attempts by multinationals to greenwash new biotechnologies, implement the further financialization of nature, and dilute biodiversity governance to allow for the greater privatization of life.

And although the “Kunming-Montreal Global Biodiversity Framework” agreement was hailed by many as the “Paris Agreement for biodiversity”, Dr. Vandana Shiva, President of Navdanya International, pointed out back then that it actually signaled the dilution of the CBD’s role in biodiversity conservation, especially in the face of increasing corporate influence: “Thirty years after the Convention on Biological Diversity (CBD) was signed into being, the conclusions of the COP 15 signal a dilution, delay, and weakening of the obligations made. The CBD was a commitment to conserve biodiversity everywhere, and this framework falls into the corporate trap of 30×30.”

She referenced here to Targets 1, 2 and 3 which set the goal to protect thirty percent of land, and ocean areas for biodiversity conservation, and restoration. These goals were already under much controversy before the COP15, as fears of further land grabbing under the guise of biodiversity conservation on one hand. And on the other hand, the goal of thirty percent is simply not enough in the face of mass biodiversity decline.

Concerns were also raised back then at the agreement’s failure to mention the greatest vector for biodiversity loss, industrial agriculture. The most the issue is mentioned was in Target 7, which references pesticide reduction as necessary for curbing pollution. But this brief mention failed to address the other multidimensional effects agribusiness has had in the destruction of biodiversity. This includes the effects of GMOs on the erosion of biodiversity, monocultures, and genetic erosion of species.

The framework also did not make any mention of regulation of new gene edited gmos, gene drives and other genetic manipulation techniques that have detrimental consequences on biodiversity.

To this, Dr. Shiva remarked, “The CBD and the Cartagena Protocol were supposed to regulate GMOs for Biosafety, but instead, in these thirty years, GMOs have decimated biodiversity. Not addressing this impact, which was part of the original mandate, is a failing. This failing is particularly worrying given that everywhere GMOs are being deregulated. The CBD has a role in arresting this deregulation, which it has not taken.”

Instead of more corporate accountability, the Kunming-Montreal Global biodiversity framework opened the doors to corporate greenwashed solutions, such as “Nature-Based Solutions”, “biodiversity credits” and “green bonds” which risk a greater financialization of nature.

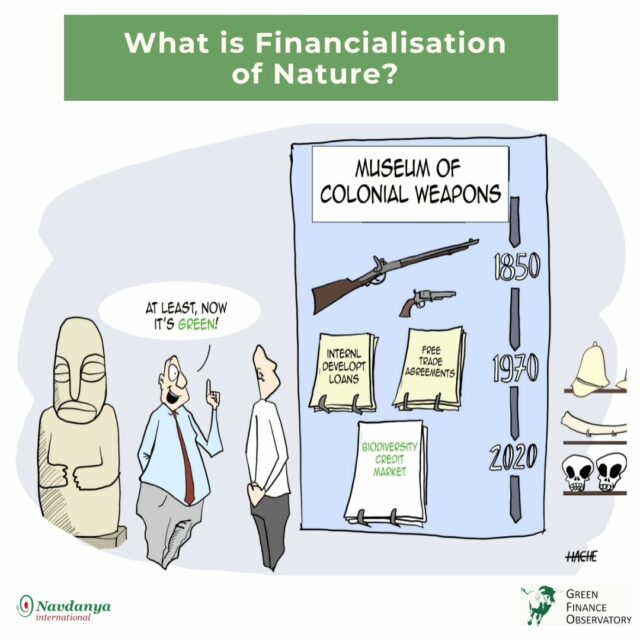

Financialization of Nature

In the name of biodiversity “conservation” and “protection”, the financial sector is increasingly making calls for a new form of bio-imperialism through the false solution of financializing nature and biodiversity through a number of market mechanisms like biodiversity credits, and Nature Asset companies (NACs). These are the financial sector’s attempts to commodify whole ecosystems, in territories where there is the greatest biodiversity, the territories of indigenous peoples.

Organizations such as, Finance for Europe (AFME) and EY have proposed for the upcoming CBD COP recommendations around the creation of biodiversity credits, and Nature Asset companies (NACs) to provide finance to global south countries to conserve biodiversity.

This arises from the CBD’s call for the need of increased finance for developing countries from wealthier countries to help support the conservation and protection of biodiversity. Specifically, as part of the draft global framework to be presented at this COP, a USD $200 billion increase in financial flows for biodiversity conservation.

The finance sector has been arguing that since, currently, 87 percent of funding for biodiversity comes from public finance, philanthropy and development institutions, and it is still not enough to cover all restoration and protection needs, private funding can come in to lessen the global biodiversity finance gap. Since they recognize that all industry and financial markets are intrinsically dependent on nature, they propose attaching measurable valuation schemes such as “nature-based solutions”, blue finance or ocean carbon/ biodiversity credits, and regenerative agriculture credits, to help protect what they deem as natural assets. This also includes the financialization of biodiversity, ecosystem services, and anything deemed “natural capital”. All under the guise of ‘protecting’ it. But if these sound familiar, it’s because many of these finance schemes are similar to those proposed for climate change finance, which have already been called out as greenwashed buzzwords being used to maintain the status quo.

There are many alarming aspects to the financial sector’s attempts to commodify whole ecosystems. These schemes essentially allow the historically plundering financial sector to determine what in nature has value, and what ecological communities and ecosystems are not assets deemed of protecting. The financialization of nature will only lead to the further commodification of the last remaining commons of the world, folding into the market economy the last remaining part of the natural world that had remained outside human purview.

Biodiversity Credits

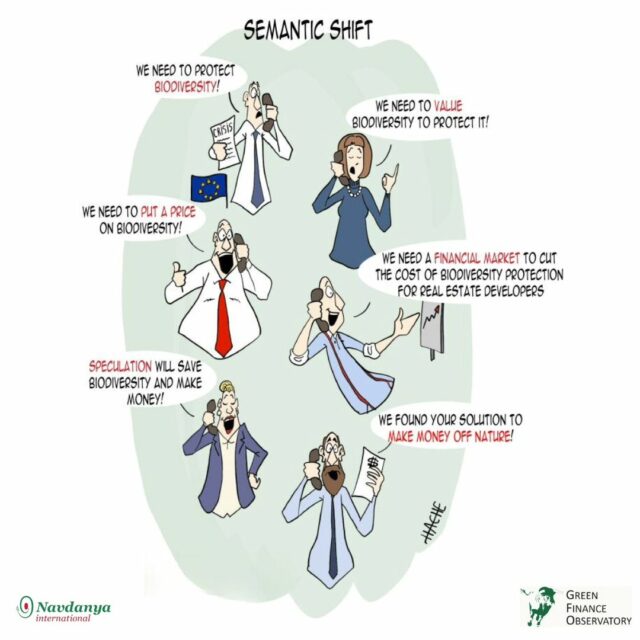

One of the ways of valuing ‘natural capital’, includes biodiversity credits, or a financial scheme which finances biodiversity actions through the creation, sale and exchange of biodiversity ‘units’.

The World Economic Forum foresees that the biodiversity credits market might hit $2 billion by the decade’s close, equivalent to the present scale of the voluntary carbon market. By 2050, it could surge to nearly $70 billion.

Former investment banker, Frederic Hache, who is also a lecturer in sustainable finance at the Paris Institute for Political Studies and founder of think tank Green Finance Observatory (GFO) says: “Basically, what’s happening now with biodiversity is what happened with carbon 15 years ago, only much bigger.”

The main appeal of these new financialization schemes is the virtually unlimited potential for profit generation. As crucially noted by the Green Finance Observatory: “It is important to understand that biodiversity credits derive their political appeal only from their ability to delay meaningful action to curb destruction in rich industrialized countries.”

Hache rightfully warns that “We’re about to see the launch of a biodiversity offset market comparable to the carbon offset market with the same flaws but only worse, because the environment integrity issues are magnified by the fact that instead of having six greenhouse gases, you have millions of species that you are trying to standardize and oversimplify into a liquid asset.”

Furthemore, as highlighted by Chausson et. al. (2023) in “Going beyond market-based mechanisms to finance nature-based solutions and foster sustainable futures” it is important for us to recognise “how the financialization of natural capital is underpinned by the worldviews and power dynamics responsible for climate change and biodiversity loss”. Thus, the paradigms responsible for the climate and biodiversity crises we face today cannot offer solutions to the same crises. They also note that “achieving the CBD 2050 vision of ‘living in harmony with nature’ requires attending to the issues of power, politics, and justice which sit at the core of the unsustainable status quo and shape flows of money and capital.”

Anyone who creates, values and holds “biodiversity credits”, can now hold the exclusive rights to ecosystems, ecosystem services, land, and other beings, and ecological processes. The total commodification of nature, and ecosystems is extremely worrying, as nature is not a mere mechanism for profit, but is intrinsic in its own right to exist and thrive. It is not for financial robber barons to determine what in life has value. These schemes will also directly lead to land grabbing, as has already occurred through carbon credit systems, as 80 percent of the world’s biodiversity is in indigenous territories.

France and the United Kingdom have initiated the development of a framework for a worldwide biodiversity market via the International Advisory Panel on Biodiversity Credits. Their goal is to reveal this blueprint at the COP16 summit scheduled for later in October this year (2024).

Even though the Biodiversity Credit Alliance (BCA), supported by the United Nations, has disapproved of corporations using biodiversity offsets to assert „nature positive“ claims, there remains ambiguity regarding the distinction between biodiversity credits and offsets. Green Finance Observatory has rightfully pointed out, in response to the draft proposals and consultations with the BCA that “biodiversity credits and offsets are identical” and that it is “preposterous and politically naive” to think that the credits won’t be used for offsetting. GFO also notes that the alliance “is an extremely imbalanced forum, that the IIED (International Institute for Environment and Development) who provides the secretariat of the CAP and the UN itself are not neutral arbiters, being long time promoters of biodiversity markets.”

In recent developments, the World Economic Forum along with Mc Kinsey and Co have formed the “Frontrunners Coalition” which aims to develop the biodiversity credit market. This coalition is made of corporations from extractive industries of mining, fossil fuels, and pharmaceuticals.

As history has shown us, corporate appropriation of the commons and of nature has never resulted in the greater protection of nature. The reason for today’s crisis is due to the extractivist, profit-driven, and mechanistic mentality of the corporate sector. There is zero evidence to suggest that all of a sudden, the likes of the Rockefeller Foundation, Blackrock, the World Economic Forum, and others corporate interests will ever have the public, the planets or nature’s best interest in mind. A sector that has been destroying biodiversity and nature will not all of a sudden come in and save it.

The attempts at commodifying life, through the financialization of biodiversity and ecosystems, really just represent the continuation of corporate interest to commodify life. While at the same time, fully vertically integrating every aspect of their product chains from the very ecosystem functions that make their products possible, to extend ultimate control over every level of life. What is at risk here is the final encroaching on the complete privatization and commodification of life.

Biodiversity is Life

What we must recognise is that biodiversity, far from being an asset or a commodity, is a continuum. In resistance to the extractive worldview of the financial sector stands the worldview that recognizes the interconnectedness, interrelatedness, and interdependence of all facets of Creation and Life.

The Earth is vibrant and living. All is interdependent, interconnected, and interrelated through the web of life. All is relational. The Earth gives us life; she is Sacred Mother Earth. We are all connected through biodiversity, from the soil microorganisms, to plants, animals, our food and our microbiome. We are all made and interconnected through these living webs of diversity. Just as the biodiversity of life connects us all, so does our cultural diversity, our language diversity, and the diversity of our struggles. Diversity is the thread that connects us all.

The health of all ecosystems is determined by Biodiversity. Biodiversity is diversity in life. Earth-based knowledge systems, in the hands of women and indigenous people, who now take care of 80% of the Earth’s remaining biodiversity, recognize that cultivation of biodiversity lies in living in harmony with nature and honoring the complex web of relationships in nature, not in its further commodification.

It is this relational paradigm that has gifted the biodiversity of soils, and the interrelationships of plants and animals, and that over millennia co-evolved into diverse cultures and knowledge systems based on health, resilience and care for the land. Nature’s rights and people’s rights are inseparable and fundamental to the health and the well-being of both humanity and the Earth.

We must recognize that we are interconnected, one and part of Nature, and must follow the laws of Nature. Harming the Earth means harming oneself. This is how we resist the commodification and financialisation of nature.

Join us on May 21st, 2024, for a